Universal Display 3Q Miss & The Reality of Gen 8.6 IT OLED Expansion

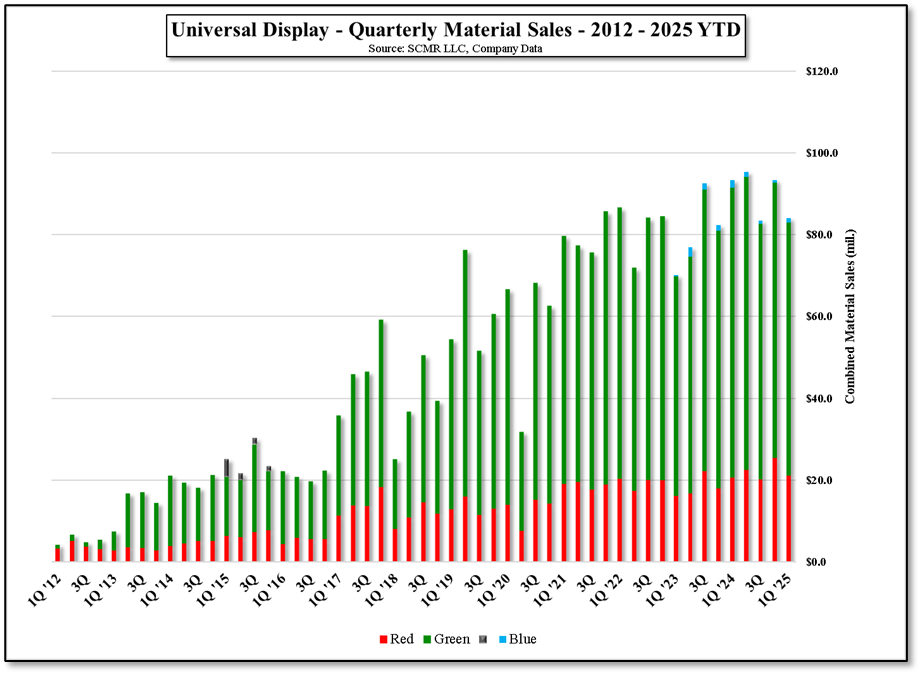

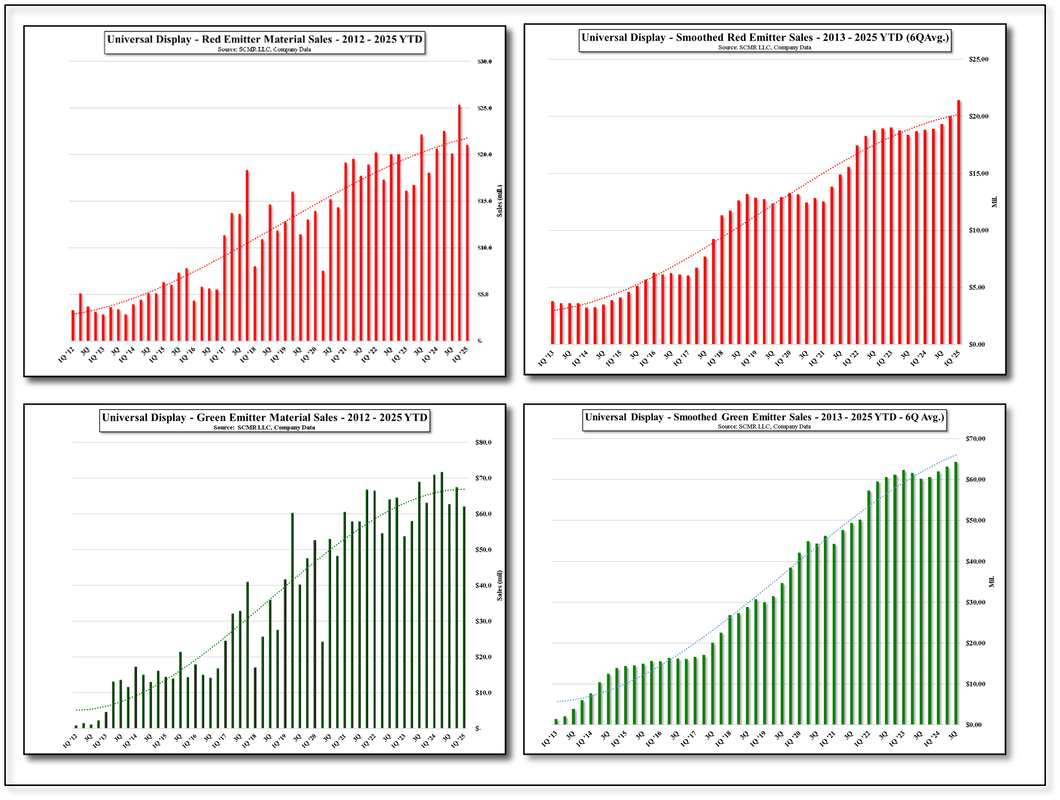

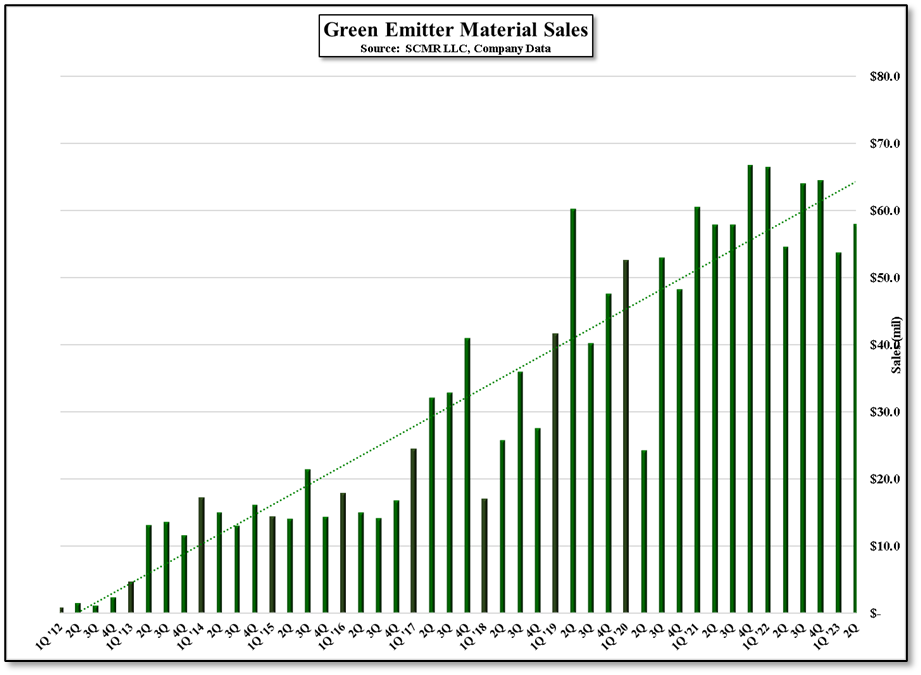

Universal Display (OLED), the display industry’s primary supplier of Phosphorescent emitter materials, fell short of consensus estimates for 3Q.

- 3Q Revenue Miss - Revenue was $139.6 million, down 18.7% q/q and down 13.6% y/y. below expectations of $166.1 million, down 3.3% q/q but up 2.8% y/y.

- UDC management indicated that the material pull-ins that they saw during the 1st half were more significant than expected, leading to the shortfall.

- The company took a one-time charge of $9.5 million that reduced license & royalty for the quarter. This was to fix an error is recognition that occurred in 2023.

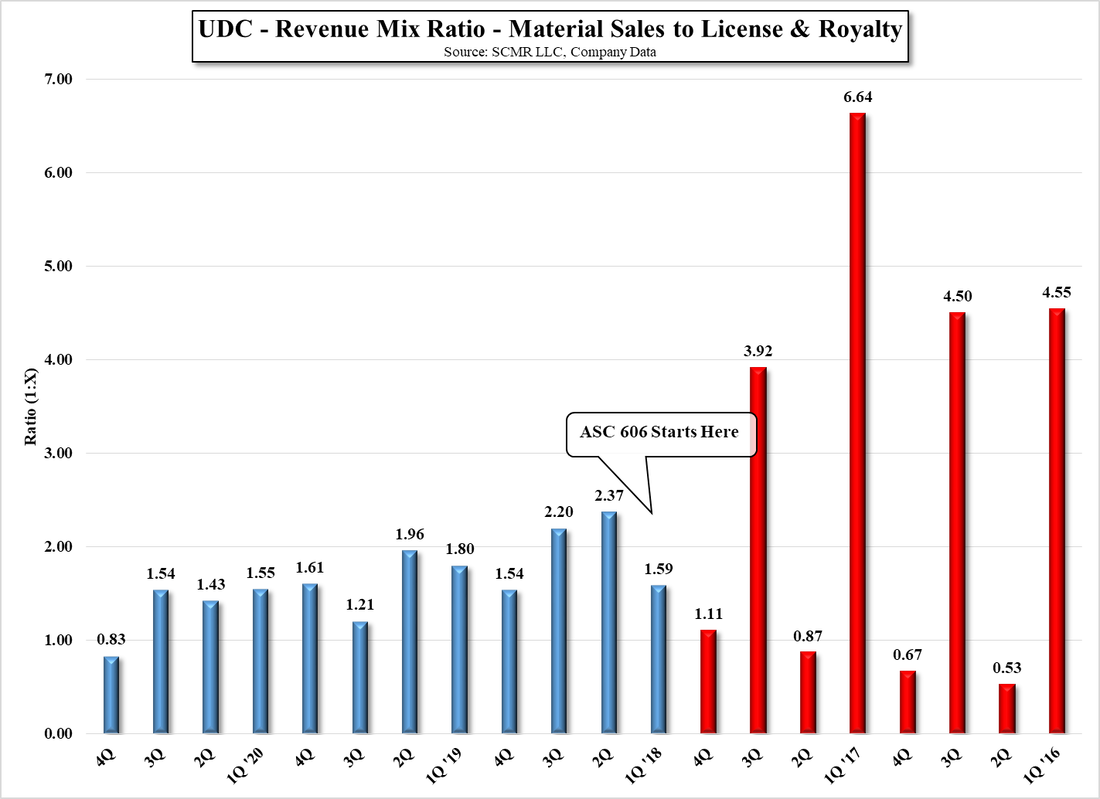

- Material sales were down 6.8% q/q and down 1% y/y, while license and royalty revenue was down 29.5% q/q and down 28.5% y/y. Adjusted for the one-time charge License & Royalty was still down 17.0% q/q and down 15.8% y/y.

OLED Capacity Growth – The Gen 8.6 IT OLED Paradox

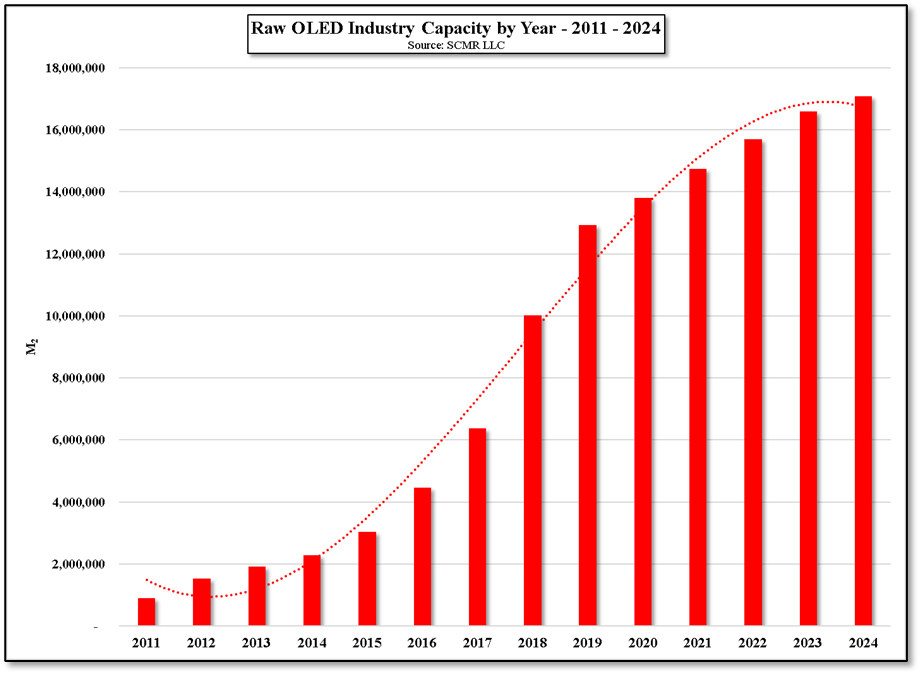

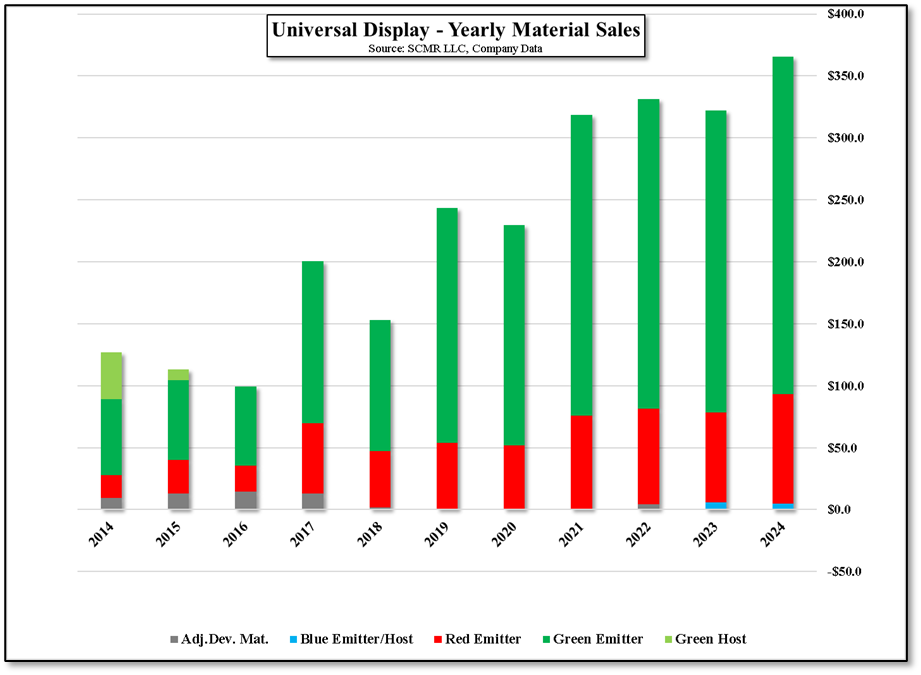

UDC’s growth rate has leveled off as OLED capacity expansion has been limited. Future material sales growth is now contingent on increased OLED adoption as the driver for material sales growth until Gen 8.6 IT OLED fab capacity kicks in While we do see OLEDE adoption expanding, ,we believe investors might be reading too much into the incremental capacity that these new fabs might contribute. Two critical metrics will be the indicators for the pace for actual capacity expansion, Yield/Utilization and Customer Demand.

Fab Utilization & Yield Challenges

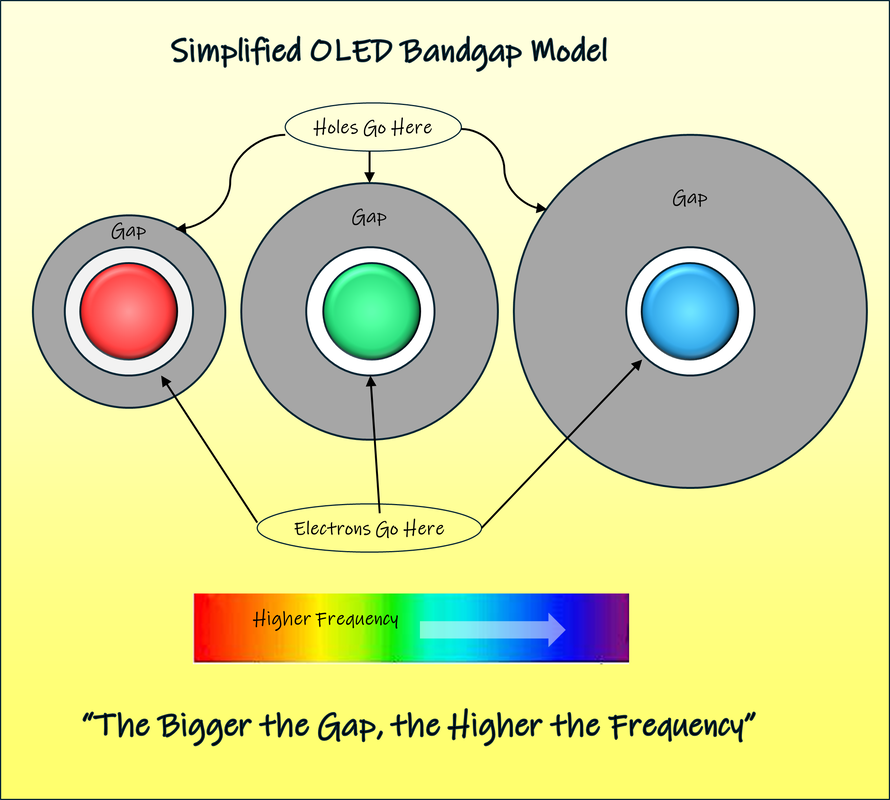

New Gen 8.6 OLED lines, especially those from BOE (200725.CH) and Samsung Display (pvt), are pioneering the production of OLED panels on large substrates. This new technology introduces significant ramp-up risks.

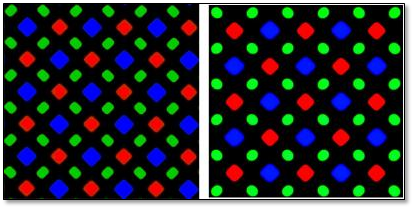

- Utilization is the rate at which the fab is using its stated production capacity. Most OLED fabs are set up in 15,000 sheet/month increments, so a 15K fab producing 10,000 sheets/month is running at a 67% utilization rate.

- Yield is the percentage of ‘good’ panels that are produced, regardless of the utilization rate. In this example we assume 72 panels can be cut from each sheet equaling 720,000 display panels/month. If 72,000 display panels are rejected each month, the fab has a 67% utilization rate and a 90% yield.

- Initial profitability is determined by the combination of these two metrics. determine the fab’s profitability and new fabs are typically not profitable when they first begin commercial production. In the case of both BOE and Samsung Display, neither has had experience producing OLED panels on large substrates, and both Visionox (002387.CH) and Chinastar (pvt) are using technologies that have yet to be proven in a mass production setting. This means that yield will take time to build and profitability for these fabs will be a bit far off.

To UDC, yield is less important than utilization as panels that don’t work when they come off the line still require OLED materials, while fabs that are underutilized use less OLED materials, An ideal utilization rate would be 100%, meaning the fab is producing at full capacity 24/7, and an ideal yield would be 100%, meaning every panel produced is acceptable, however that Is rarely the case as deposition tools need to be cleaned, masks replaced along with a variety of other reasons for down time. We would expect a new fab of this type to begin mass production at 50% yield and 50% utilization. Using the model above, the fab would be producing 360,000 displays each month, half of which (50% yield) would not be viable, leaving 180,000 to be sold to customers, likely at a very substantial loss (materials run between 60% and 70% of panel costs)..

In a normal scenario, yield improves with time, the more mature the process, the faster the yield improvement, so investors should expect an extended period when yield remains below material costs, before fixed costs are added. But what really drives panel production profitability are customers, as they drive utilization

Customers drive utilization

Fabs operating at 90%+ yield will still lose money if they are running at low utilization. They cover material costs because the yield is high, but they have trouble covering fixed costs. This also comes into play when new fabs enter into commercial mass production for the first time. Unless they have orders, they are producing for inventory, not only a costly scenario but one with considerable risk that the panels will never be sold or will have to be sold for less than expected. Distributors, OEMs and specialty display producers can buy these panels from the producer, but early run panels or panels that have been sitting in inventory can lose value quickly, so having customers lined up when a fab opens is the first step toward profitability.

Panel price is also a determinant for fab profitability as competitive pricing can destroy a panel production model as quickly as poor yield or low utilization. In the case of the first two panel brands that will be in mass production, BOE is a very aggressive competitor, likely willing to almost give away early Gen 8.6 OLED production to both grab customers and share. UDC is in the advantageous position of having both BOE and SDC as customers, so area is most important, but if a fab is already losing money from low utilization or yield (or both) selling below cost is not going to encourage them to expand production. We expect that SDC has an advantage out of the gate as they are expected to dedicate a large portion of their Gen 8.6 OLED production to Apple (AAPL), indicating that they have been at least tacitly approved by Apple for a number of products. This is great to have in your pocket when opening a new fab, but plans, markets, and timelines change, and nothing is written in stone until the contract is signed.

Final Outlook: Capacity vs. Adoption

The complexity inherent in building and ramping up Gen 8.6 IT OLED lines with novel technologies introduces numerous variables that can quickly change the market dynamics. While this new capacity will certainly be incremental to UDC's material sales, the key questions for investors remain:

- At what pace will the Gen 8.6 transition develop?

- Will this new capacity spur overall OLED adoption or will it lead to an over-capacity situation in the IT OLED segment?

RSS Feed

RSS Feed